Understanding Crypto Staking: A Guide to Earning Passive Income

Written on

Chapter 1: Introduction to Crypto Staking

Crypto staking has emerged as a significant trend in the evolving landscape of cryptocurrencies, offering users a way to earn passive income. As Bitcoin and Ethereum achieve record-breaking values, the surge in interest from both institutions and individuals alike makes it vital to comprehend the terminology and workings of this technology.

Understanding these concepts is essential; without it, investing can feel more like gambling than a strategic endeavor. Among the most commonly misunderstood terms is "crypto staking." Many view it as a straightforward method to increase their crypto holdings, but what does it truly entail? Is it a risk-free venture?

In this article, we will explore the fundamentals of crypto staking, its potential implications, and the opportunities it presents in the ever-expanding crypto market.

Section 1.1: The Background of Decentralized Cryptocurrencies

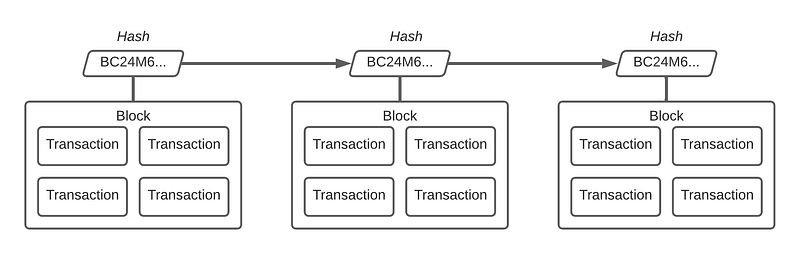

Decentralized cryptocurrencies provide a means for individuals to transfer funds without relying on a central authority. At the heart of this system is the blockchain, a public ledger that records every transaction and account balance transparently. Imagine it as a comprehensive spreadsheet that documents all transactions since the currency's inception.

However, a challenge arises: how to prevent someone from spending funds they do not possess?

Traditionally, banks and institutions handle transaction verification, but blockchain technology bypasses this necessity. Bitcoin mining plays a crucial role in this ecosystem, validating transactions through a process that groups multiple transactions into blocks. Miners receive block rewards for their efforts, incentivizing them to maintain the network's integrity.

This video titled "What Does STAKING Even Mean? Types of Crypto Staking EXPLAINED" delves into the concept of staking and its relevance in the crypto space.

Section 1.2: Understanding the Mining Process

The Bitcoin blockchain is not merely a linear sequence of blocks; it functions more like a tree. Occasionally, two miners may generate a block simultaneously, resulting in two branches. The mining community must then determine which branch receives the rewards, adhering to the longest chain rule to establish an official blockchain.

Calculating the correct hash for a new block is an immensely challenging task, comparable to the odds of guessing the number of stars in the universe. This complexity explains why entire facilities are dedicated to Bitcoin mining and why concerns about its environmental impact are growing, as it currently accounts for about 0.5% of global carbon emissions.

Section 1.3: From Proof of Work to Proof of Stake

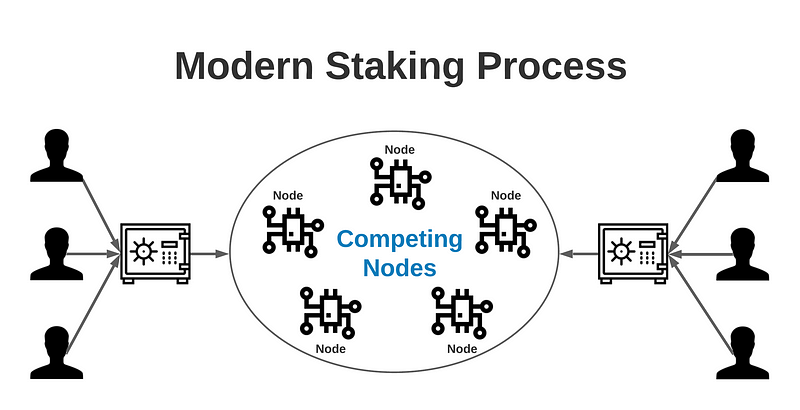

To combat hacking risks, the proof-of-work system mandates extensive computational efforts for transaction validation. In contrast, proof-of-stake (PoS) is gaining traction as an alternative method.

In PoS, instead of relying on computational power, users stake their own cryptocurrency tokens, akin to purchasing lottery tickets. By depositing funds, such as Ethereum’s Ether, into a collective pool, participants’ coins can be utilized by network nodes to compete for generating new blocks and earning rewards.

Chapter 2: The Staking Landscape

Ethereum is transitioning from a proof-of-work to a proof-of-stake model with Ethereum 2.0. While the main network has been launched, full adoption is anticipated between 2021 and 2022.

Staking can be conducted through crypto exchanges or staking pools, each with its pros and cons. Exchanges provide a straightforward option but often come with fees, while pools allow collective staking but may require more research and vigilance.

The video "What is staking" offers insights into the staking process and its benefits.

Section 2.1: How to Begin Staking Crypto

Choosing the right method for staking your cryptocurrency requires careful consideration. Reflect on how much time and research you are willing to invest, your views on security, potential fees, and the safety of your assets during the staking process.

In my experience, I opted for Crypto.com, a rapidly growing platform that combines crypto trading with staking and offers a Visa debit card for everyday purchases. Their platform ensures your assets are securely stored in cold storage, and they boast competitive fees and attractive staking rewards.

To maximize rewards, users are encouraged to stake their native cryptocurrency, CRO. Despite this requirement, the benefits of CRO and its increasing popularity make it a worthwhile investment. My initial bonus of $25 has escalated to nearly $70 within six months.

If you’re interested, my referral code is w6jyux2vcq, allowing us both to receive a $25 bonus when you purchase and stake CRO.

In summary, if you are holding cryptocurrency on platforms like Coinbase, consider transitioning to an exchange that allows you to earn passive income through staking today.

This article is intended for informational purposes only and should not be taken as financial or legal advice. Always consult a financial expert before making significant investment decisions.