The Hidden Value of Thrift Shopping: More Than Just Savings

Written on

Chapter 1: The Significance of Thrift

Wisdom often arrives in unexpected forms, especially when it comes to financial growth. Today, I want to share a thought from Thomas Jefferson, a key figure in American history, who stated: “Never spend your money before you have earned it.” This straightforward idea is often overlooked in our current age of easy credit, leading many to purchase items they cannot truly afford.

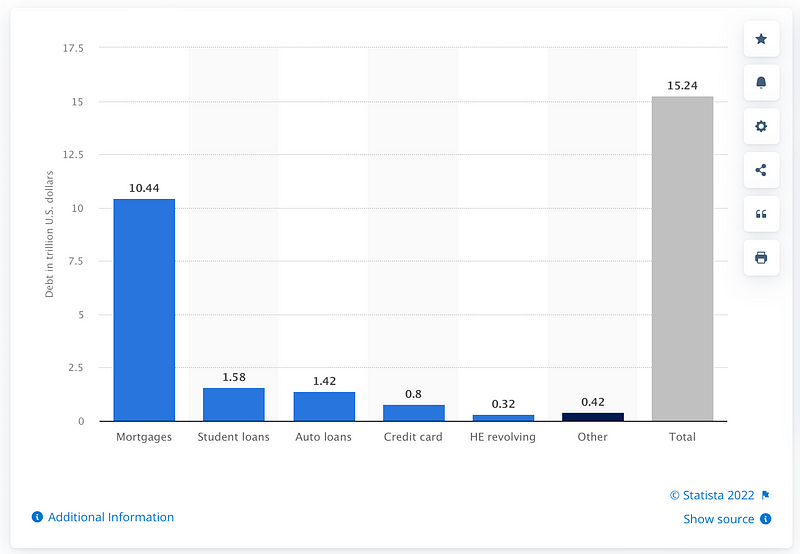

As of Q3 2021, Statista reported that total household debt in the US reached a staggering $15.24 trillion. A breakdown of this debt reveals mortgage obligations as the largest contributor:

Image by Statista

A Bankrate article from 2020 outlines average consumer debts across various categories (noting that many households have multiple individuals contributing):

- Mortgage: $208,000

- Home equity (HELOC): $42,000

- Student Loan: $39,000

- Auto Loan: $20,000

- Personal Loan: $16,000

- Credit Card: $5,000

The total debt quickly accumulates, prompting the question: What are the average monthly payments for this debt? A 2020 LendingTree article provides insight into typical monthly payments:

- Mortgage payment: $1,255

- Car payment: $493

- Personal loan payment: $458

- Credit card payment: $244

- Student loan payment: $300

- Other debt payment: $248

That's a significant amount of money flowing out to creditors each month!

From personal experience, I can attest that accumulating debt makes wealth building incredibly challenging. I once found myself in a similar situation: burdened by a hefty mortgage, car loans, and private school fees for my child. I was living beyond my means, and despite a substantial income, my financial growth was stagnant as most of my earnings went directly to servicing debt.

Utilizing debt to elevate your lifestyle is not a viable strategy for wealth accumulation. To genuinely build wealth, one must spend less than they earn and invest the surplus in appreciating assets that generate income. While this concept isn't complex, it requires emotional discipline.

We often feel pressured to keep up with friends who have lavish homes or coworkers with new cars, but remember that their debt may not be fostering their financial health. It's far better to minimize expenses, allowing you to invest in assets like real estate or stocks. If all your funds are tied up in a depreciating luxury vehicle, how can you expect to grow your wealth?

The priority should be to stabilize your finances before indulging in such purchases. Reflect on your lifestyle choices and spending habits as you navigate your financial journey.

Best of luck, and don’t hesitate to reach out if you need assistance!

Building Financial Resilience

After facing difficulties in building wealth early in my career while adhering to traditional financial wisdom, I embarked on a quest to learn about investing. A decade later, I have achieved financial stability and am working toward full independence through real estate and stock investments. I have established my "financial ark" to withstand any economic storms.

I created Building Arks to assist busy professionals like you in disregarding conventional advice and genuinely creating wealth.

Image by jeffjacobs1990 on Pixabay

If you want to receive notifications when I publish new content, consider joining my mailing list.

Interested in generating additional income through writing on Medium? I earned over $6,000 in my first year! Join for just $5 a month, and I will receive a portion of your subscription fee, allowing you unlimited access to thousands of articles, including my own, while helping you launch your writing career.

Here are some valuable articles on wealth building and investing that you may find beneficial:

- My 6-Figure Passive Income Plan: Insights on achieving financial success.

- The Rules You Need to Know to Build Wealth: Essential strategies for financial growth.

- Who is Right, Dave Ramsey or Robert Kiyosaki?: A comparison of financial philosophies.

I have no affiliations with any of the mentioned sites, and I do not receive compensation from partners or recommendations in my articles (with the exception of Medium). I am not a legal, accounting, or certified financial advisor. All information is shared in good faith based on my knowledge and experience. It should not replace professional advice, and consulting an expert before making any financial decisions is always advisable.

Chapter 2: The Benefits of Thrift Shopping

Thrift shopping extends beyond merely finding bargains; it can also contribute significantly to financial well-being. Many shoppers discover that thrift stores offer unique treasures at a fraction of the original price. This practice not only saves money but also promotes a sustainable lifestyle, reducing waste by giving pre-owned items a second chance.

The first video discusses the numerous advantages of thrifting, emphasizing the value found in items beyond their price tags.

Exploring thrift stores can also lead to unexpected finds that enhance personal style and creativity.

The second video delves into the benefits of shopping at thrift stores, showcasing how these experiences can redefine one’s shopping habits and financial outlook.

By embracing thrift shopping, not only can you save money, but you can also make thoughtful choices that align with a wealth-building mindset. Remember, every dollar saved is a step closer to financial freedom!