The Evolving Global Landscape of EV Battery Metals Supply

Written on

Chapter 1: Introduction to EV Growth and Supply Chain

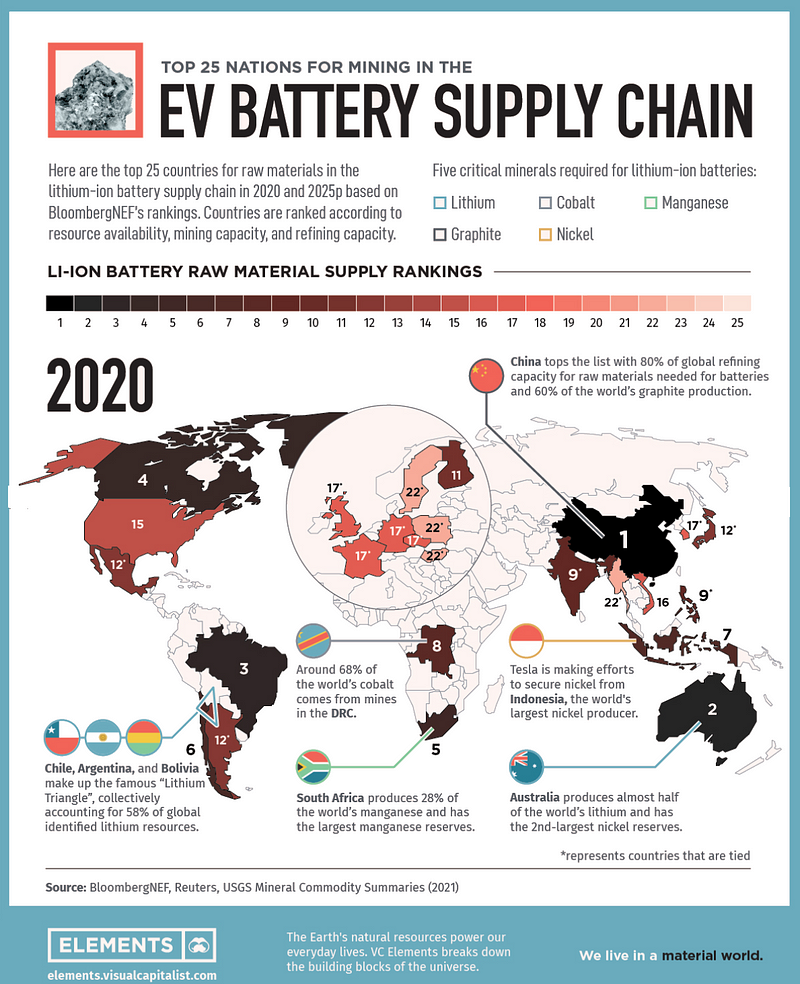

Recently, I discussed the remarkable surge in Electric Vehicles (EVs) and the critical role of the supply chain in this growth. Among the various components, batteries stand out as the most vital and costly, relying heavily on specific minerals and elements for their functionality. The infographic presented here, based on BloombergNEF data, ranks the leading 25 countries in the production of essential raw materials for lithium-ion batteries, reflecting the landscape from 2020 and projections for 2025.

Section 1.1: Key Metals Essential for Lithium-Ion Batteries

While numerous materials are utilized in the creation of EV batteries, five metals are deemed crucial: Cobalt, Lithium, Manganese, Nickel, and Graphite. Several countries are significant players in the extraction and manufacturing of these metals. Miners in these regions process high-grade raw materials into chemicals that will be used in the production of EV batteries.

Subsection 1.1.1: Methodology for Ranking Countries

To evaluate different nations, BloombergNEF applied various criteria such as mineral resources, mining capabilities, and refining capacities as of 2020. This data was subsequently used to forecast the operational capacity for the key five metals in 2025. Countries were then classified into a scale from 1 to 5, indicating their capacity from lowest to highest, with an overall score derived from the averages of these categories.

Section 1.2: Observations from the Study

Key findings from the research include:

- China: Currently dominates the refining of these essential metals, holding an 80% share in 2020. It is projected to maintain a leading position in 2025, although its mining capacity may decrease to 75%. Moreover, China is the largest producer of graphite, which is crucial for lithium-ion batteries.

- Australia: Accounts for approximately 50% of global lithium production and possesses the second-largest nickel reserves worldwide. It is expected to retain its second position through 2025.

- Brazil: Holds the third position, being one of the top 10 producers of graphite, nickel, manganese, and lithium. However, Canada is anticipated to surpass Brazil by 2025 as the only cobalt refinery in North America is currently under construction.

- South Africa: With the largest known manganese reserves, it produces 28% of the world’s manganese and is projected to rise from fifth place in 2020 to fourth by 2025.

- Democratic Republic of Congo (DRC): Contains 68% of the world’s cobalt reserves but is expected to drop from eighth place in 2020 to tenth by 2025 due to a shift toward ethically sourced cobalt.

- Indonesia: As the leading nickel producer, it is gaining traction, with Tesla actively seeking to secure supplies from the region. Indonesia is projected to enhance its position from seventh to fourth place by 2025.

- Sweden and Japan: Expected to experience significant advancements, moving up five and four spots to 17th and 8th respectively by 2025, primarily due to anticipated increases in mining capacity. Japan is also constructing its first lithium hydroxide refining plant.

With a global push towards the adoption of EVs, the transformation of the battery metals supply chain is a development worth monitoring closely.

Chapter 2: Insights from Video Discussions

The first video titled "Where 6 Metals Used For Electric Cars Come From | True Cost | Insider News Marathon" explores the origins of the key metals essential for electric vehicles. It provides insights into the global supply chain and the environmental impact associated with these materials.

The second video, "Japan discovers game changing 230 million tons of rare EV battery metals," discusses Japan's significant discovery of rare metals that could revolutionize the battery industry and enhance the EV supply chain.